With WiseFax online fax service, you can fax forms to IRS in just a few seconds. With WiseFax, you can also get a local fax number by subscribing to one of our short term plans which allows you to receive fax response from IRS. Here, we will explain how to get a fax number, send documents to IRS and receive their response by fax.

- Visit WiseFax website.

- Sign-in or register and click the “Get your fax number” button to activate your fax number, and get fax tokens for sending IRS form.

- Upload your IRS form to WiseFax and select pages that you wish to fax.

- Follow further steps to send form to IRS.

- Later, you will find potential IRS response fax among your received faxes.

Get your own fax number now!

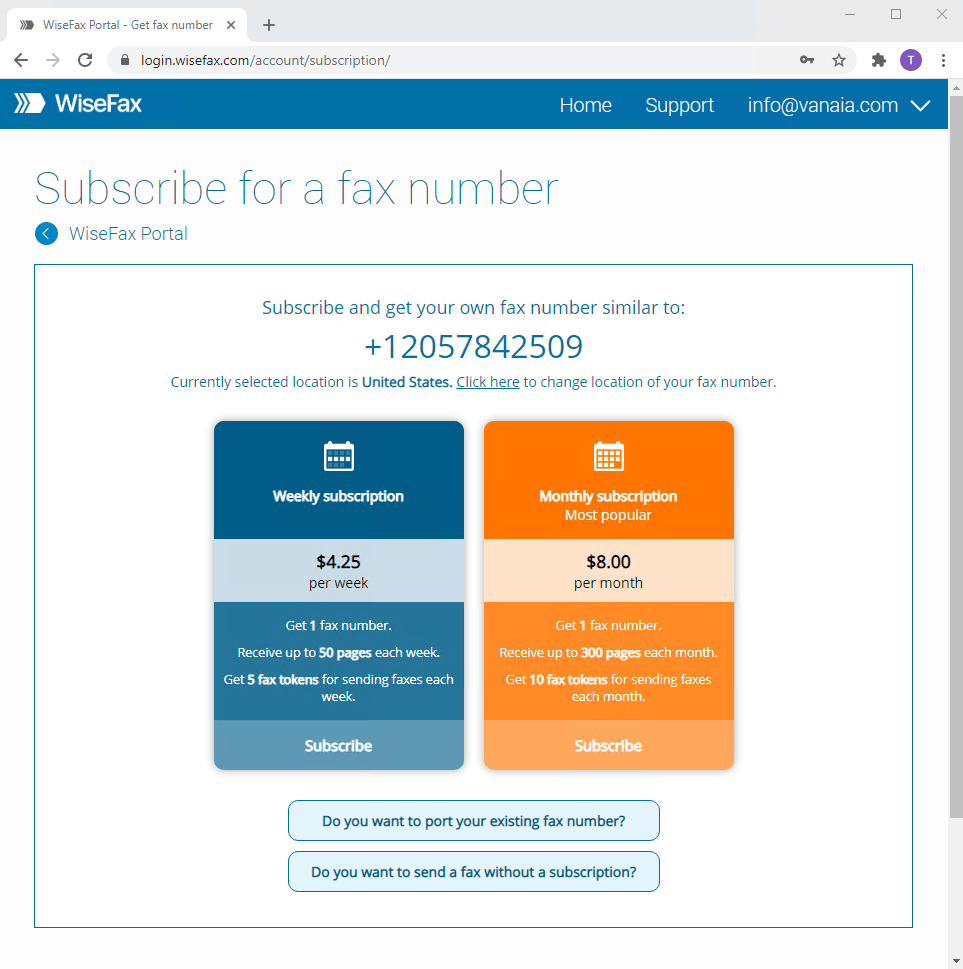

You can get your own US or Canada based fax number for the fixed weekly cost of $4.25 (or for the fixed monthly cost of $8.00). Subscription to fax online service includes one fax number and your own online fax machine, to which you can receive up to 50 pages (e.g. IRS fax responses) per week (or 300 per month), and additional 5 fax tokens each week (or 10 fax tokens each month) that you can use for sending faxes. There are no start-up or cancellation fees.

Your own online fax machine is just a few steps away, so get your fax number now and start receiving fax responses instantly. Your fax number will be active for as long as your subscription. The subscription will automatically renew at the end of each subscription period. And, if you no longer need your fax number, you can cancel your subscription at any time at no extra cost.

Your own online fax machine is just a few steps away, so get your fax number now and start receiving fax responses instantly. Your fax number will be active for as long as your subscription. The subscription will automatically renew at the end of each subscription period. And, if you no longer need your fax number, you can cancel your subscription at any time at no extra cost.

How to fax a form to IRS?

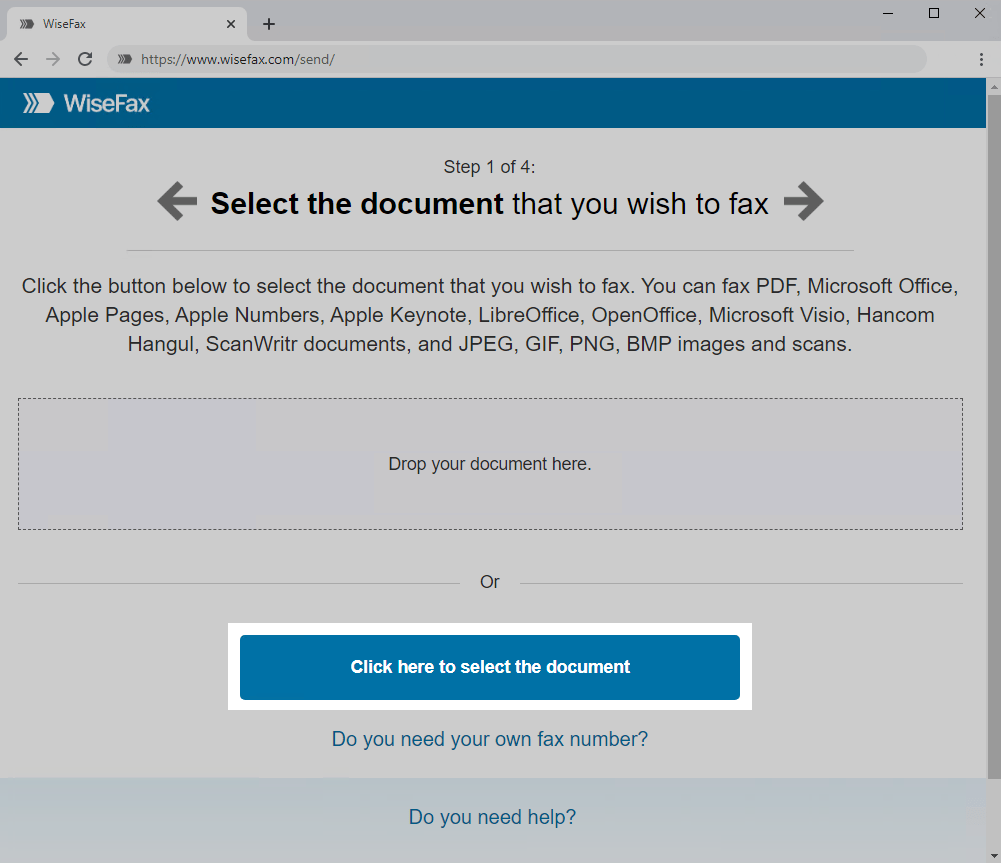

WiseFax is a simple to use website that allows you to send IRS form by fax quickly, easily and securely. Simply start by uploading your IRS form to WiseFax.

To upload your IRS form, use the Click here to select the document button. A new window will pop-up where you will be able to select the IRS form that you wish to fax.

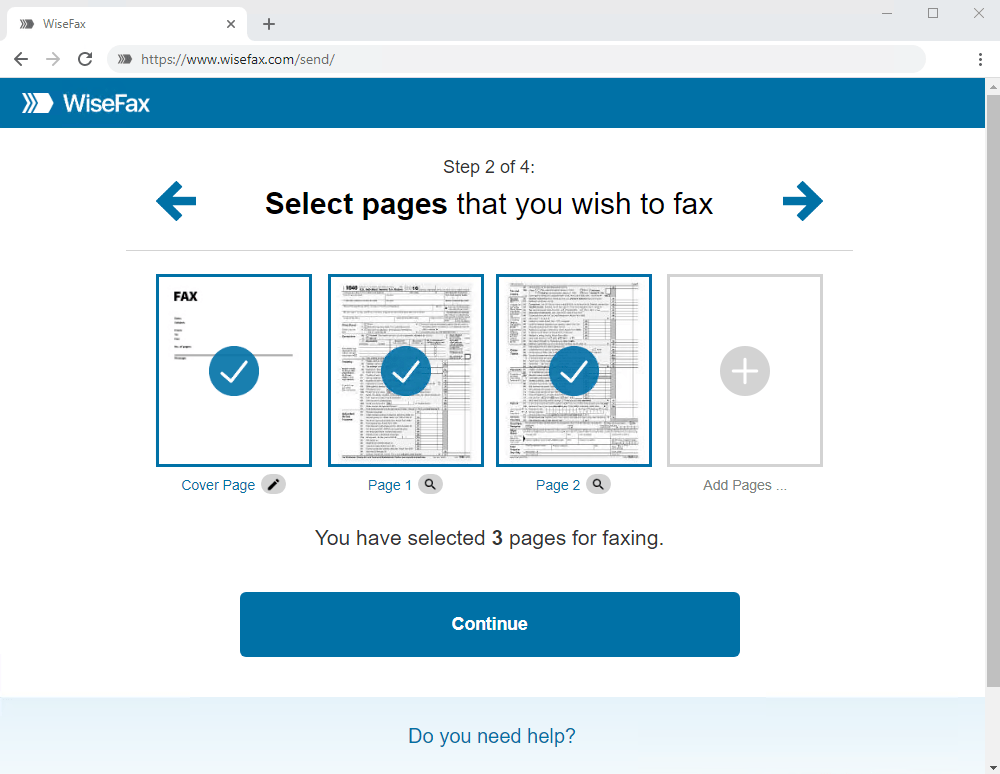

In the next step, select pages that you wish to fax. If you wish to add additional pages from another document, simply click on the Add Pages and select the document that you wish to add pages from.

Press the Continue button, once you have selected all pages that you wish to fax.

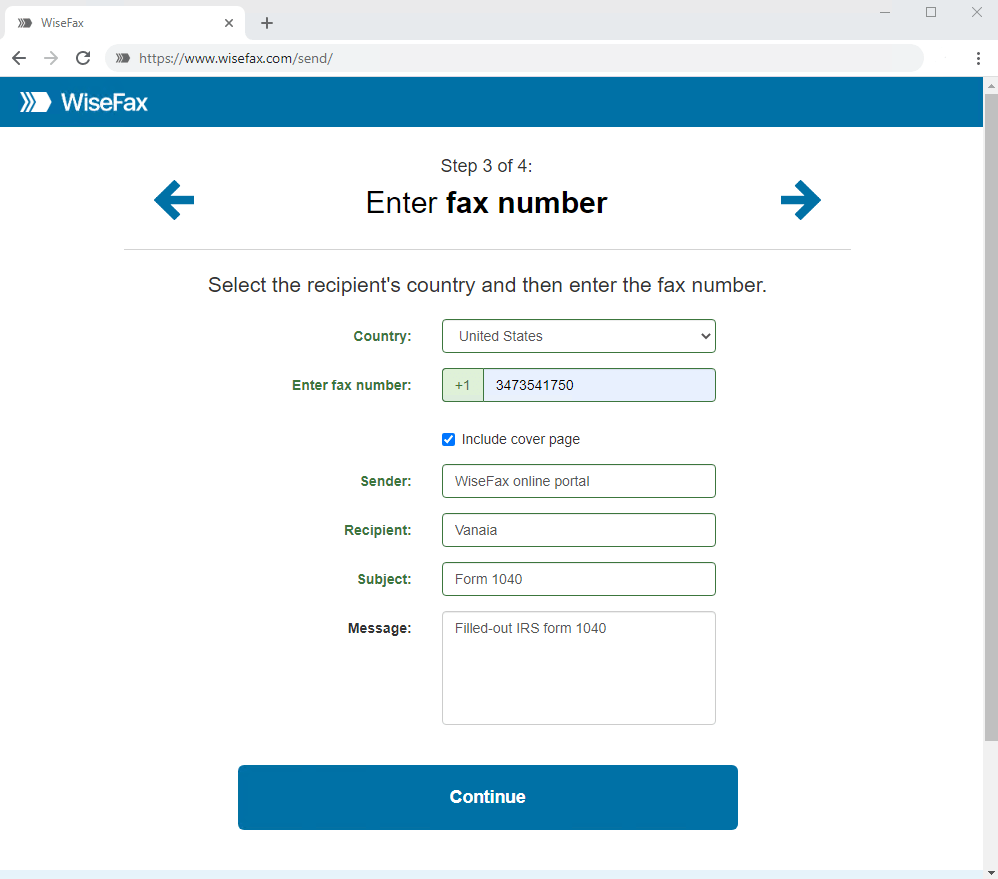

Enter the recipient’s fax number in the next step, then click Continue.

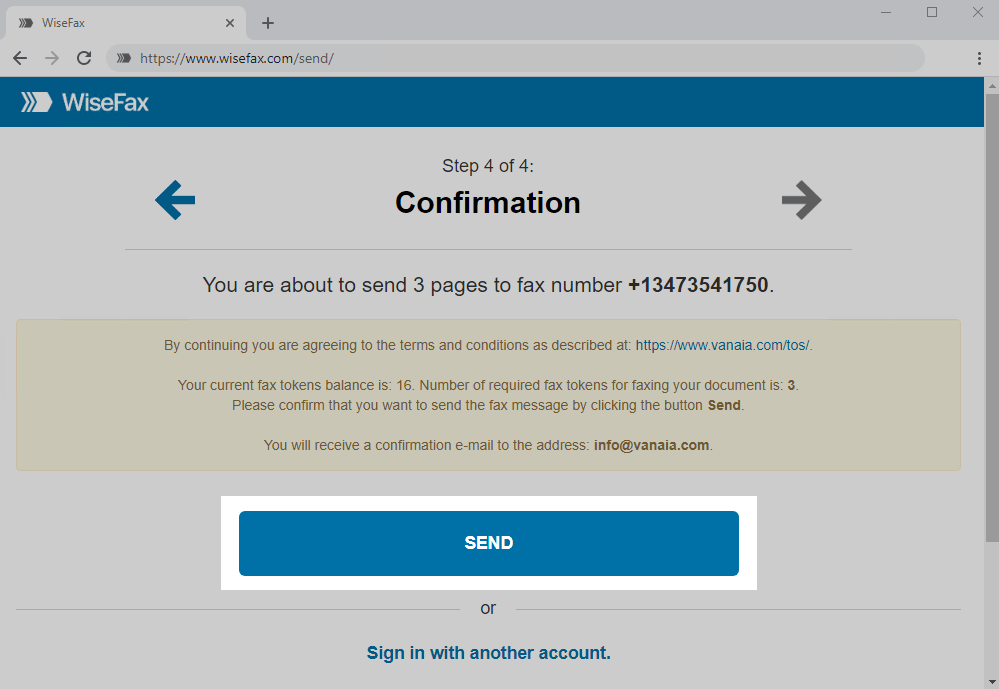

Select an account that you wish to use to fax your IRS form. You can sign in with your Google, Apple, Microsoft Live, Facebook or Vanaia account. The last step to send IRS form by fax, is to click the Send button. You will receive an e-mail notification as soon as WiseFax will start processing your fax. This usually happens couple of seconds after you had pressed the Send button.

You will receive an e-mail confirmation as soon as your fax will be delivered to the IRS.

If for some reason WiseFax will be unable to fax your document, then you will also receive an e-mail notification from WiseFax. You will then be able to fax your form once again later without purchasing additional fax tokens.

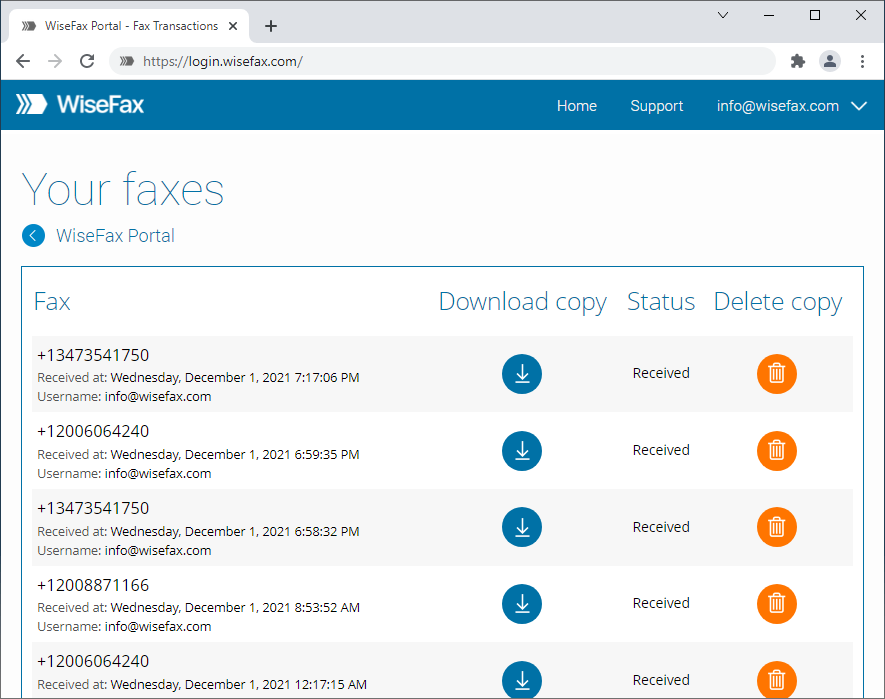

How will you receive IRS fax response?

With WiseFax subscription you get a fax number and your own online fax machine. All received IRS fax responses, as well as other faxes, are securely stored and available to you in WiseFax portal. Even more, every time a fax will be received to your fax number, we will send you an email with a secure download link. So, you will be able to download the received fax easily, quickly and securely as a PDF document.

If you prefer, you can also opt for receiving faxes in your email as PDF attachment. This option can be found in the WiseFax portal under the Secure Fax section.

So, now you know how to get your own fax number, how to send IRS form by fax, and how to receive IRS response by fax.

More resources

How to fax PDF document?

How to send fax online?

WiseFax online fax service

How to fax Word document?

How to send fax from Google Docs?